Credit cards have become an integral part of our lives. You can easily and quickly make purchases with just a swipe. But this convenience comes at a huge cost. Credit cards are scary money tools that can ruin your finances if you don’t use them wisely. Keep these 10 reasons in mind the next time you want to use a credit card:

1. Credit Cards Encourage Overspending

Studies have shown over and over that people spend more when they use credit cards instead of cash. This is because swiping a card doesn’t feel like real money. It’s also harder to control your spending when you use credit cards. One study found that people spend 10% more when they use credit cards than when they pay with cash. It’s too easy to whip out the plastic and overspend.

2. Credit Cards Lead to Accumulation of Debt

Credit cards allow you to spend future income today. It gives the illusion that you have more money than you actually do. This makes it very easy to accumulate debt over time. Before you know it you are drowning in credit card debt you can’t repay. This debt can snowball out of control due to high interest rates charged by credit card companies.

3. Credit Cards Have High Interest Rates

The average credit card interest rate is over 24%. This means that if you have a balance, almost a quarter of the things you buy are used to pay interest. Companies that issue credit cards make a lot of money every year from people who can’t pay off their balances in full. The high interest costs can be crippling.

4. Credit Cards Have Predatory Fees

In addition to high interest rates, credit cards also charge a myriad of fees like annual fees, cash advance fees, balance transfer fees, foreign transaction fees and over limit fees. These fees are purposely designed to maximize profits for credit card companies. The fees can add significantly to your overall costs.

5. Credit Cards Can Wreck Your Credit Score

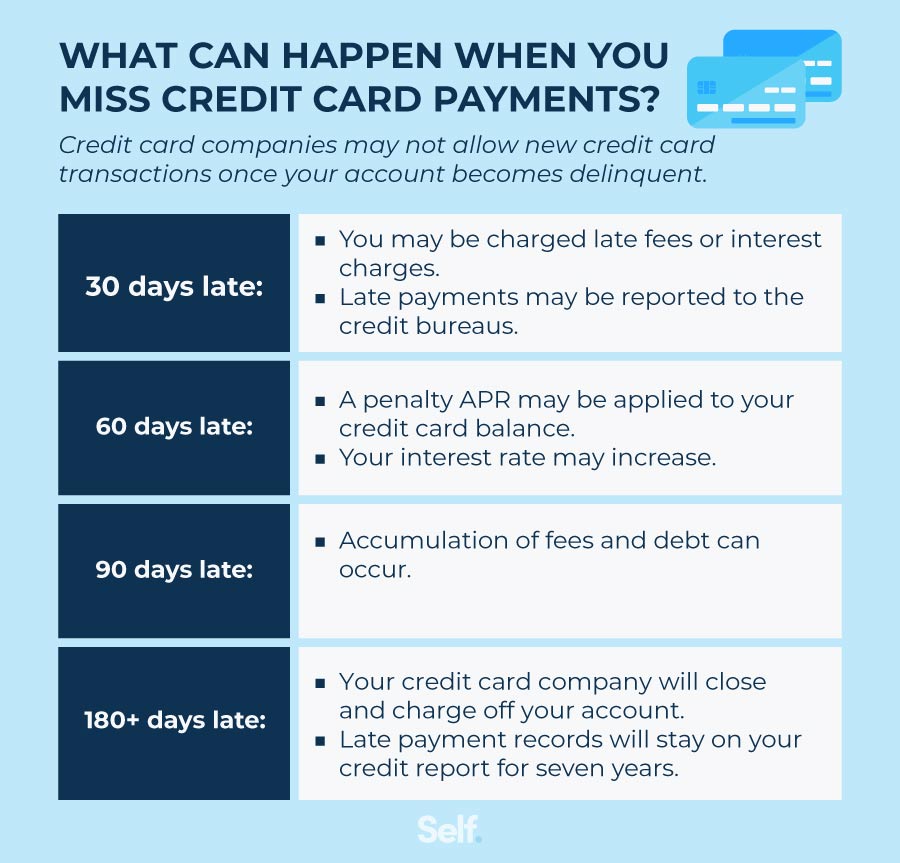

If you miss payments, max out cards or accumulate too much debt, your credit score takes a hit. A lower credit score makes it harder to get loans or good interest rates. Landlords and insurance companies may also charge you more for having a lower score. Credit cards can quickly damage your credit if used irresponsibly.

6. Credit Cards Lead to Anxiety and Stress

Many people feel very stressed and anxious when they have a lot of credit card debt. It’s bad for your mental health to constantly worry about how you will pay off your growing debt. On the other hand, not having any credit card debt can give you peace of mind.

7. Credit Cards Enable Bad Spending Habitss are creatures of habit. When you consistently use credit cards to make purchases, it reinforces the habit of buying on credit. This makes it harder to break the cycle of relying on credit cards in the future. Avoiding credit card use in the first place is the best way to enforce fiscal restraint.

8. Credit Cards Have Predatory Rewards Programs

The rewards programs offered by credit cards seem enticing, but often cost you more than they are worth. Credit card companies rely on these programs to encourage more spending and borrowing. The extra costs incurred often outweigh the value of the rewards. It’s a psychological ploy to get you to spend more.

9. Credit Cards Can Lead to Bankruptcy

For people buried deep in credit card debt, declaring bankruptcy may seem like the only option. But bankruptcy has severe long-term consequences and should be avoided if possible. Relying extensively on credit cards can set you on the path towards bankruptcy. It’s better to not use them at all.

10. You Can Live Without Credit Cards

Perhaps the best reason to avoid credit cards is that you don’t really need them. Debit cards provide almost all the functionality of credit cards without the temptation to overspend. Personal loans can help finance large purchases without the endless interest payments. With fiscal discipline, you can live a perfectly normal life without credit cards.

The bottom line is credit cards are hazardous to your financial health. The short-term convenience they provide is far outweighed by the long-term pain they can inflict on your finances. Break free from the shackles of credit card debt by pledging to stop using them altogether. Your future self will thank you.

Credit cards give you the illusion of having more money than you do

Credit cards have a psychological trick they play on you that doesn’t matter how much money you have in the bank or how well you understand how credit cards work.

When you have a generous $10,000 credit limit staring at you on a credit card, it feels like you have an extra $10,000 available to spend. But you dont. Its not real money.

One effect of this illusion is that it can make people think they don’t need as much short-term savings, like an emergency fund. When you have no credit limit and you only use real money, you are motivated to save up enough to feel secure because you dont have a “safety net” of credit. But having a credit limit can make you less likely to save more, which is a healthy urge. This can lead to you not putting enough effort into your savings plan, which can lead to problems later and put you in debt when you need to pay for something unexpected.

People tend to spend more when they use credit cards and chase points

The number one pushback I get on credit cards is points. Just about everyone I talk to uses points as the reason they use them and most people are pretty adamant that they are coming out ahead.

There is a ton of data available proving that people tend to spend more when they use a credit card.

From Forbes:

“When someone buys an item with cash, they immediately know how much that item cost, which can be painful. However, when someone pays with a credit card, there is a time period between when they purchase the item and when they have to pay for it, which makes the cost seem less important, according to Psychology Today.”

According to the same research cited above, people tend to spend 100% more when using a credit card versus spending with cash.

MIT also did a study suggesting consumers overspend when using credit cards because credit cards “step on the gas” in the pleasure centers within the brain.

Credit card companies know this and lean into this even more by gamifying the system with points (including cash back and miles). They know that if they make you feel like youre getting a deal then you are likely to feel even less friction when using your credit cards.

Its the same reason the major retailers still use coupons and special offers. It gets us to buy more stuff.

Think about it for a minute. Would credit card companies push points so hard if they didnt make money on it?

Now, a common argument to this point is “Well, I track my spending very carefully. This doesnt apply to me.” Maybe. But think about other areas in life here we lie to ourselves. Those who are into fitness often use all sorts of “assists” to help them stay motivated. Joining group classes. Doing online classes. Working with a personal trainer. Using apps. These are all acknowledgements that sometimes self-discipline is not enough. We benefit from “life hacks” or other guardrails that keep us focused on the behavior we want. It would be easy to say “Well, I dont need help staying focused on my fitness goals… I have self-discipline!” But in reality, most of us are perfectly willing to admit that behavioral assists are really helpful in overcome the gaps we can have in motivation.

The same goes for food in the fridge. If we buy a bunch of junk food and put it in the front, then were pretty likely to each a bunch of junk food. But if we stock the fridge with healthier choices, were probably going to eat a little healthier simply due to convenience. Especially if we put that food in the front where its more accessible. Not many people would argue with this. Its human nature.

There are plenty of other examples. But for some reason when it comes to credit cards, many people give themselves an unrealistically high score on self-discipline.

I Stopped Using a Credit Card For 30 Days and THIS Happened!

FAQ

Why should you never use credit cards?

Credit cards make it easy to buy things you may not be able to afford. When you don’t pay for things right away, it can feel like you’re spending “free money,” which can make you spend more than you mean to. This can result in carrying a balance that you’ll have trouble paying off.

Why does Dave Ramsey say not to use credit cards?

Ramsey often says that millionaires don’t get rich by using credit cards, pointing out that 2% cash back on a $1,000 purchase is only $20.

What is the 2/3/4 rule for credit cards?

The 2/3/4 rule is a credit card application restriction specifically used by Bank of America. It limits the number of new credit cards you can be approved for within certain timeframes.

What are the negatives of using a credit card?

Cons of credit cards include:Potential high-interest rates and fees. Temptation to overspend. Risk of accumulating high debt. Possible to fall behind on payments. Potential to max out your credit limit. Potential to damage your credit history and score.