Are you or a loved one on Social Security? I’ve got some fantastic news that’ll make your wallet a bit happier next year! After years of meager increases, seniors and other Social Security recipients will see their biggest raise in decades when 2022 rolls around.

The Big 2022 Social Security Raise: What You Need to Know

The Social Security Administration has announced a 5.9% cost-of-living adjustment (COLA) for 2022. This is the largest increase since 1982, and it comes at a critical time when many seniors are feeling the pinch from rising prices at the grocery store, pharmacy, and gas pump.

Here’s what this means in real dollars:

- The average retired worker will see their monthly check increase from $1,565 to $1,657 (a $92 boost)

- A typical aged couple, both receiving benefits, will see payments rise from $2,599 to $2,753 (a $154 increase)

- Disabled workers will see their average benefit climb from $1,282 to $1,358

- A widowed mother with two children will receive approximately $3,187 (up from $3,009)

The increase will take effect with December 2021 benefits, which are payable in January 2022. For SSI recipients, the new rates begin December 31, 2021.

Why Such a Big Increase This Year?

In simple terms: inflation. The Social Security COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of each year. Inflation has been running hot in 2021, pushing up the cost of essentials like:

- Food

- Housing

- Energy

- Medical care

As prices have climbed significantly over 2021, Social Security recipients are getting a correspondingly larger adjustment to help maintain their purchasing power.

Beyond the COLA: Other Important Changes for 2022

The COLA isn’t the only thing changing in 2022. Here are some other important updates:

Higher Tax Cap

The maximum amount of earnings subject to Social Security tax will increase from $142800 in 2021 to $147000 in 2022. This means higher-income earners will pay Social Security taxes on more of their income.

Earning Test Limits Increase

If you’re working while collecting Social Security before full retirement age you can earn more in 2022 without having benefits reduced

- If you’re under full retirement age for all of 2022, you can earn up to $19,560 before any benefits are withheld (up from $18,960)

- In the year you reach full retirement age, the limit jumps to $51,960 (up from $50,520)

Maximum Benefit Goes Up

The maximum Social Security benefit for a worker retiring at full retirement age will increase from $3,148 per month to $3,345 per month.

Is the 5.9% Raise Enough?

While the 5.9% COLA is substantial, many senior advocacy groups point out that it may still not fully offset the rising costs seniors face, especially for healthcare and housing. The way the COLA is calculated (using the CPI-W) doesn’t perfectly reflect the spending patterns of older Americans.

Many seniors spend a higher percentage of their budget on medical care and prescription drugs, which often rise faster than general inflation. Some experts and lawmakers have called for using a different index, the Consumer Price Index for the Elderly (CPI-E), which might better reflect seniors’ actual expenses.

Possible Future Changes: The Social Security Expansion Act

Looking beyond 2022, there’s a proposal that could provide even more relief to seniors. The Social Security Expansion Act, introduced by Rep. Peter DeFazio and Senator Bernie Sanders, would boost benefits for recipients by $200 per month – an annual increase of $2,400.

This proposal would:

- Add $200 to each monthly Social Security check

- Base future COLAs on the CPI-E instead of CPI-W

- Improve benefits for lower-income earners through the Special Minimum Benefit program

- Extend student benefits to age 22

- Increase the Social Security payroll tax on higher-income workers

The bill would create a “donut hole” where earnings between $147,000 and $250,000 wouldn’t be taxed, but income above $250,000 would be subject to the payroll tax again. This would affect only about 7% of earners but could extend the program’s solvency through 2096.

What Should Seniors Do With Their Raise?

With the biggest raise in decades coming your way, it’s a good time to think about how to use those extra dollars. Here are some smart ideas:

- Review your budget – Update your monthly spending plan to account for inflation and your increased benefits

- Build emergency savings if possible – Even a small cushion can help with unexpected expenses

- Address debt – Consider putting some of the increase toward high-interest debt

- Check your Medicare coverage – Medicare Part B premiums are expected to rise in 2022, potentially offsetting some of your COLA

- Consider inflation-fighting investments if you have additional savings

The Bottom Line

The 5.9% Social Security COLA for 2022 represents the largest increase in 40 years and will provide much-needed relief to millions of Americans who rely on these benefits. While it may not completely offset all the price increases seniors are experiencing, it’s a significant boost that will help maintain purchasing power during these challenging economic times.

For the average retiree, that extra $92 per month adds up to more than $1,100 over the year – money that can help with rising costs at the grocery store, pharmacy, and beyond.

We’ll keep watching for any further developments that might affect Social Security recipients, including potential legislative changes that could provide additional support in the future. Until then, you can look forward to seeing that bigger check starting in January 2022!

Have questions about how the 2022 COLA will affect your specific situation? The Social Security Administration’s website (ssa.gov) offers personalized benefit information through your my Social Security account, or you can call them directly at 1-800-772-1213.

Inflation ticked up in August, but analysts still predict a modest bump in benefits

Social Security recipients now have the second of three data points that will determine their cost-of-living adjustment (COLA) in 2026.

A key gauge for inflation — the Consumer Price Index for Urban Wage Earners and Clerical Workers (known as the CPI-W) — rose by 2.8 percent in August 2025 compared with one year ago, according to data released Sept. 11 by the federal Bureau of Labor Statistics (BLS). Members only

Annual COLAs are based on how much the CPI-W changes in the third quarter of the year — July, August and September — from the same period the previous year. The CPI-W rose by 2.5 percent in July compared with the previous year. The final COLA for 2026 will be announced in October.

A CPI-W of 2.8 percent for August suggests that Social Security recipients may see a modest bump in their Social Security payments starting in January 2026.

You’ve worked hard and paid into Social Security with every paycheck. Here’s what you can do to help keep Social Security strong:

“I expect something similar next month — maybe a bit higher due to the current volatile and unpredictable import tax regime,” says Indivar Dutta-Gupta, a distinguished visiting fellow with the National Academy of Social Insurance, referring to the Trump administration’s tariff policies.

“I do suspect that the August and September figures will nudge [the 2026 COLA] up toward 2.7 percent,” Dutta-Gupta says.

The final inflation number that goes into the COLA calculation will be released on Oct. 15, when the Social Security Administration will announce the COLA for 2026.

A 2.7 percent COLA would increase the average benefit for a retired worker — which in August 2025 was $2,008 a month — by about $54. The average monthly survivor benefit ($1,575 in August) would inch up by about $43, while the average payment for a worker collecting Social Security Disability Insurance ($1,583 in August) would go up by $43.

ARTICLE CONTINUES AFTER ADVERTISEMENT

Teresa Ghilarducci, a labor economist at New York City’s New School for Social Research, expects a COLA of about 2.8 percent but says that “probably won’t be enough to cover the inflation rates that we’re headed into” if the tariffs remain in place. The Supreme Court has agreed to hear a case challenging the legality of those import taxes.

The 2025 COLA, which was based on third-quarter inflation data for 2024, boosted the average Social Security retirement benefit by about $49 a month. The 2024 COLA of 3.2 percent pushed payments up by $59 for the average retiree. Members only

Helping older adults keep up

Bill Sweeney, AARP’s senior vice president of government affairs, says the annual COLA is one of the most important elements of the Social Security program.

“This wasn’t originally part of Social Security,” he says, noting that in 1972 AARP fought to make COLAs automatic rather than subject to a congressional vote.

“For many people, Social Security is the only inflation-protected income they have in retirement,” Sweeney says. And for more than 50 years, he adds, the COLA “has allowed America’s seniors to keep up as everyday costs continue to rise — from groceries to housing to prescription drugs.”

Some older adults may also benefit from a new $6,000 tax deduction for older taxpayers included in the recent “One Big Beautiful Bill.” The measure applies to taxpayers 65 and older with incomes below a certain threshold, starting with their next tax filing and running through the 2028 tax year. After that, it is set to expire. AARP supported the tax provision’s inclusion in the legislation.

Social Security Pay Raise Announced – See the Exact Amount Seniors Will Get!

FAQ

Will Social Security benefits increase in 2022?

Approximately 70 million Americans will see a 5.9% increase in their Social Security benefits and Supplemental Security Income (SSI) payments in 2022. Federal benefit rates increase when the cost-of-living rises, as measured by the Department of Labor’s Consumer Price Index (CPI-W).

Will seniors get a cost-of-living adjustment in 2022?

Seniors will receive a cost-of-living adjustment of nearly 6% in their Social Security checks for 2022. This is considered one of the program’s biggest increases in decades, but it’s not all good news.

How much will social security increase in 2021?

Retirees and other beneficiaries will see their monthly Social Security checks increase by 5.9% in 2021 — the biggest hike in roughly 40 years. For comparison, 2021’s COLA was just 1.3%, and they have generally landed between 1% and 3% in any given year.

Will social security increase in 2023?

The spike will boost retirees’ monthly payments by $146 to an estimated average of $1,827 for 2023. The hefty increase, which follows a 5.9% adjustment for this year, is aimed at helping Social Security’s roughly 70 million recipients contend with the high inflation that’s been plaguing the US since last year.

How much cola will Social Security receive in 2022?

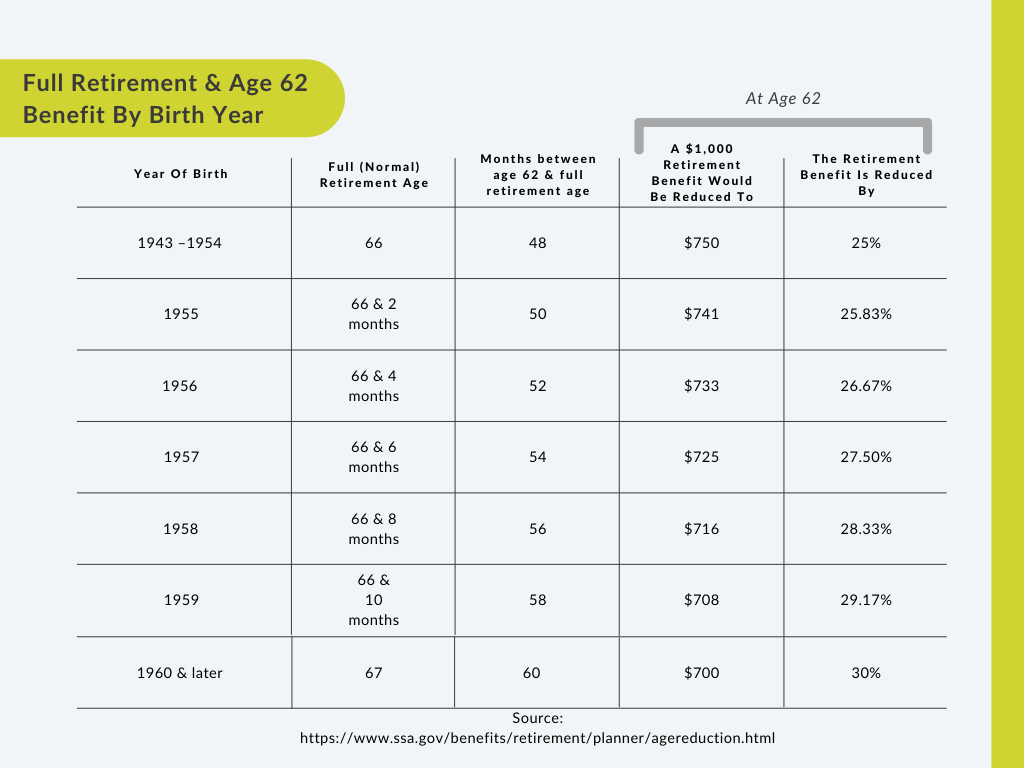

Based on the increase in the Consumer Price Index (CPI-W) from the third quarter of 2020 through the third quarter of 2021, Social Security and Supplemental Security Income (SSI) beneficiaries will receive a 5.9 percent COLA for 2022. Other important 2022 Social Security information is as follows:

Would a social security bill give seniors extra $2400 a year?

Social Security bill would give seniors an extra $2,400 a year. Here’s how it would work. Seniors and other Social Security recipients in the U.S. are being hit hard by inflation, which has outpaced increases in their benefits this year.

How much of a raise will senior citizens get in 2025?

Social Security and Supplemental Security Income (SSI) benefits for more than 72.5 million Americans will increase 2.5 percent in 2025. Read more about the Social Security Cost-of-Living adjustment for 2025.

Will Social Security get an increase in 2026?

Will seniors get an increase in 2025?

Will local government retirees get a raise in 2025?

What is the amount of the cost-of-living adjustment? For the year 2025, annuitants who retired under CSRS will receive 2.5 percent increase and those who retired under FERS will receive a 2.0 percent increase.